How To Calculate 401k Return When Constantly Adding Money

The Best Portfolio Management Software Makes Your Life Easier

Investors need the best portfolio trackers to monitor their mutual and exchange traded funds, individual stocks and bonds for many reasons. You want to examine your investment returns, fees, asset allocation, as well as plan for retirement and more. And you need the best personal investment software to do it right! Of course you can do it by hand or with an investment tracking spreadsheet, but with the excellent investment portfolio management software available, why bother? From free investment software, to a one-time payment or on-going fees, there has never been a better selection of portfolio software on the market. Both price and features matter and we'll explore both.

We'll start out with the free portfolio trackers and wealth management software, next the investment and stock portfolio trackers that charge an ongoing fee. Embedded in many of the platforms is asset allocation software, to keep your investments in line with your goals and risk tolerance.

The best portfolio analyzer is one that meets your investing portfolio management, tracking and budget needs. We'll cover investment tracking software, able to handle stock tracking, ETF and mutual fund trackers.

*Disclosure: Please note that this article may contain affiliate links whichmeans that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link.

Free Portfolio Management Software

1. Personal Capital

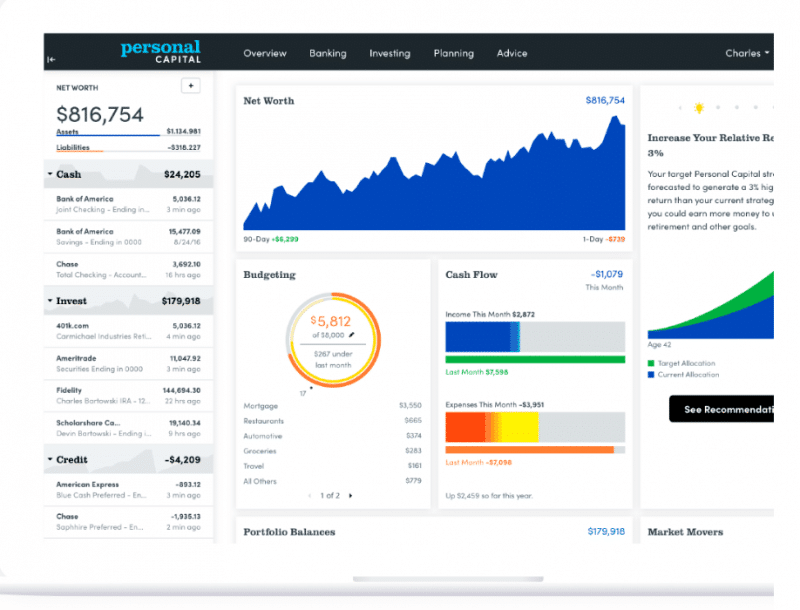

Personal Capital may be the top free investment and portfolio management software. The platform, with mobile and computer access has a load of features. The easy set-up takes a few minutes to sync your accounts after which your personalized dashboard is available. The Personal Capital finance dashboard incorporates all of your bank, credit card and investment accounts and gives you a 360 degree view of how your investments are performing along with other useful money information.

The Personal Capital portfolio tracking software and tools help you:

- Analyze your cash flow including both income and expenses

- Calculate your net worth – including updated home value

- Check on and analyze your investments

- Plan for retirement

- Analyze your account fees

- Perform an investment check up

- Review your asset allocation

- More

The investment check-up offers priceless tools – kind of like your best portfolio analyzer. The overriding question that the investment check-up answers is "Could your portfolio give you greater returns for a reasonable risk level?" The program answers this question by comparing your current asset allocation to the recommended target, and recommending improvements.

The retirement planner calculator tells you best and worst case retirement scenarios. It shows how much monthly spending your current portfolio will allow throughout retirement.

This is my "go to" resource to check on and analyze my investment performance, and income versus spending. It's easy to use and automatically updates, unlike Quicken, where I must manually update my portfolio. The net worth calculator even maintains an updated value of our home. And, while on the go – the portfolio management app is ideal for a quick check of your investment returns.

One of the best aspects of Personal Capital is how fast and seamlessly your accounts are linked! You can be up and running in minutes!

I was amazed at how fast my complicated investment portfolio was uploaded and analyzed. I have more than 10 accounts with multiple investments within each account. Here's a sample image of a Personal Capital Dashboard with updated Net worth, cash flow and budgeting data.

I recently completed a retirement analysis, and increased my annual spending projections. The new retirement analysis showed that I'm still fine at the new spending level. It was fast and easy.

The only caveat with this tool is that you may need to field a call from a Personal Capital representative. Other than that, the tools are free to use. I consider Personal Capital a top contender for the best investment software. I appreciate how all of the accounts auto-populate so that I don't need to input data. In fact, this free portfolio management software just might be superior to Quicken portfolio management software (which I also use).

2. Mint

"Compare your portfolio to market benchmarks, and instantly see your asset allocation across all your investment accounts like 401(k), mutual funds, brokerage accounts, and even IRAs." ~Mint free investment tracker

The popular and free Mint.com investment and money management web-based software has a lot going for it. With quick linking to your accounts, similar to Personal Capital, you get a quick overview of your financial picture. Mint tracks all of your financial accounts including credit, banking, investment and retirement. Mint also highlights your fees, so that you know how much of your money isn't being invested for your future.

Mint offers these financial tools:

- Income and expense categorization and tracking

- Budgeting

- Investment tracking

- Free Credit Score

- Alerts

- Bill pay

Mint claims to help "Get the right tools for your investment style." The online portal offers tips and advice for both active and passive investors.

The Mint investment and portfolio management tools are satisfactory for beginning investors seeking a free basic money management, saving, spending, budgeting, and tracking tool. Intermediate or sophisticated investors might prefer advanced portfolio tracking and management apps like Personal Capital or Quicken.

Investment Portfolio Management Software: Fee or Subscription

3. Quicken Premier 2022

Quicken's been my go-to financial management software for decades and I continue to use both Quicken and Personal Capital to view and analyze our investment portfolios. Quicken launched an annual subscription model. This means that you need to renew annually or you'll forfeit software updates. The program also has an online app for on-the-go money management.

Similar to Personal Capital, after syncing your checking, saving, debt and investment accounts, you have a comprehensive financial management portal. The Quicken Premier platform is both basic money management, budgeting, debt tracking and cash management software as well as a comprehensive investment portfolio management program. The stock portfolio management software synchs with actual stock quotes as well as the Morningstar ® X Ray analysis tool.

Quicken premier investment management features include:

- Scores of money and investment management reports with deep level customization options

- Investment account downloading and tracking including income, dividends, fees and more

- Reports include; capital gains, rate of return, performance versus the market, investment transactions, cost basis, tax reports and more

- Risk/return analysis

- Retirement planner tool

- Portfolio X-Ray tool from Morningstar® with a detailed drill down into your overall diversification and portfolio characteristics

- Option trade tracking

In addition to the investment capabilities there are robust income, expense, budgeting and money management capabilities. This all sounds great, but I've had problems downloading data from our bank account. I'm not certain if increased bank security is to blame or the Quicken program itself.

Quicken is only available as a subscription. They have discontinued their previous offers to own the program. I don't love this extra cost, but it is consistent with many other software offers.

- Quicken Starter

- Quicken Deluxe

- Quicken Home and Business

4. Investment Account Manager

Investment Account Manager is sophisticated investment portfolio management software. The product was designed by professional money managers and used by investors globally since 1985. The goal of the software is to help you understand and manage your investment portfolios. The software for individuals is suitable for both newbies and seasoned investors. Actually, I used this software in one of it's earlier iterations many years ago. (I reverted to Quicken due to Quicken's ability to handle budgeting tasks along with investment management).

Investment Account Manager is designed for investment management, not budgeting, debt or other financial management tasks.

You can track an unlimited number of portfolios. Each investment portfolio is handled individually and transactions are segregated by account. This helps the investor to create portfolios by objective and track according to distinct parameters.

The reports section allows you to customize reports and even create reports that combine portfolios. For example, Investment Account Manager allows you to combine all portfolios and review your overall asset allocation (stocks, bonds, cash and other) and on a granular level by stock sector and size.

The data helps you determine if you're meeting your investment goals. This pdf details the 20 distinct reports available through the Investment Account Manager. The reports include detailed cost basis data to customizable income reports and more.

As this software is for investment tracking only, you'll find specific data for many types of assets including; cash, money market funds, US Government, agencies, and tax-exempt bonds, corporate bonds, preferred stocks, mutual funds, exchange traded funds, common stocks, options, and other investments.

Within the asset library, there's detailed security data including:

- Security Type

- Security Symbol and description

- Price

- High price alert

- Low price alert

- Dividends

- Earnings

- Projected dividends and earnings

- Book value

- Cash flow

- Beta

- Bond specific data

- and More

You can download the data from your broker or input manually.

The rebalancing feature makes it easy to see if your portfolio is out of balance and what securities need to bought or sold to return to your preferred allocation. There's even a sector weight allocation option.

Two more of my favorite features are benchmark comparisons and for individual stock owners, fundamental ratio analysis tools.

Additionally, Investment Account Manager also offers a professional version of the software for financial advisors.

There is so much meat in this software, that the serious investor and possibly the casual investor as well will benefit from the Investment Account Manager. The investment management software is compatible with the Windows operating system, and users can run the software on a Mac with windows emulating software.

You also get a 90 day free trial, which is quite generous! After the trial, the reduced fee is $99 per year with the QuoteMedia data feed or $69 without. Or, if you'd prefer not to renew annually, you can continue to use the software indefinitely, without access to program updates, tech support or the QuoteMedia data feed.

5. Morningstar Portfolio Manager

This freemium portfolio analyzer allows investors to import or manually enter their holdings and gain valuable insights. The free Morningstar portfolio x-ray is one of the best investment tools and shows stock style diversification, sector and style breakdowns, geographical distributing and a summary of fees and expenses. This feature is also available through a Quicken membership, and the securities are already imported.

The Morningstar Portfolio Manager is free, with limited tools, suitable for beginning investors. The free Morningstar Portfolio Manager includes:

- Investment tracking of all stocks, bonds and cash. You can either mannually input or import the securities, number of shares, purchase date and commission.

- To track your portfolio, click the "Tracking" tab. This tab shows price, percentage change, share information, market value, asset allocation percent and Morningstar fund rating. For the portfolio analysis report, you must sign up for the premium service.

- The "my performance" tab graphically shows how your portfolio performed and compares it with a designated index.

- The Morningstar X Ray uncovers how your investments in aggregate are positioned, including asset allocation, stock sector, stock type. More in depth analysis is available with the Premium subscription.

The premium investing portfolio management includes scores of features including: fund and stock screening, fundamental analysis ratios, portfolio x ray interpretation wih style, financial ratio, and expense analysis.

For more advanced investors, the premium subscription is well worth it. I've subscribed for years and use Morningstar not only for in depth portfolio analyzer but for fund and investment research. You can sign up for a free 14-day trial to the premium service. After that, the annual fee is $199 or $29.95 per month.

Visit Morningstar and take a look around.

Investment Portfolio Management Software: Robo-Advisor with Ongoing Management Fees

These portfolio management software platforms fall under the robo-advisor umbrella as well. The following companies charge low ongoing management fees and don't require you to transfer your assets to their firm. In addition to managing your assets, they also offer portfolio management features.

6. SigFig Portfolio Tracker

SigFig is a robo-advisor with a free online portfolio tracker. Although less comprehensive than Personal Capital, it's worth a try. The free portfolio tracker offers:

- Investment account sync

- Portfolio Tracker

- Reporting Dashboards

- External Portfolio Analysis-SigFig Guidance

- Live Chat/Phone Support

Anyone can use the free SigFig investment manager. The tool offers mutual fund trackers and stock tracking software.

If you want to try their robo-advisory investment manager, SigFig is a competitive service. Many low-fee robo-advisors require you to move all of your assets into the company account. SigFig offers portfolio management for investors with existing Fidelity, Schwab, or TD Ameritrade accounts. This is a convenient feature, especially if you have a larger portfolios and want to avoid the tax implications and complications of transferring your existing investments.

Our SigFig Review drills into this independent portfolio optimization platform that helps everyday investors track over $350 billion in assets. Through its partnerships with Fidelity, Schwab, and Ameritrade, the company's algorithmic investment strategies work to analyze, monitor and improve any portfolio, automatically balancing and diversifying investments, while reducing risk and minimizing fees. SigFig's Asset Management technology instantly analyzes your current investments, learns about your goals and risk tolerance, and tailors an individualized portfolio strategy. The automated systems constantly monitor and optimize your investments while reducing management fees.

SigFig's investment portfolio management services require investors to invest a minimum of $2,000 and offers free service to all accounts valued less than $10,000. For investors with accounts valued at more than $10,000, the annual 0.25% fee of assets under management (AUM) covers these services:

- Portfolio monitoring and analysis

- Access to investment advisors

- Commission-free portfolio management

- Portfolio rebalancing

- Tax reduction strategies

An investor with a $20,000 account will pay an annual 0.25% or $50.00 for the investment portfolio management fee. SigFig will tracks all of your investment accounts, regardless of where they are held.

Bonus; Personal Capital vs. Mint vs. Quicken – Which One is Best?

Investment Tracking Software – Honorable Mentions

The best portfolio tracker is the one that works for you. Personal investing software should handle a growing investment portfolio since setting up an investment tracker takes time, make your decision after thorough review.

Some of you might need a complete portfolio analysis tool, others want online investment software, while for many a simple portfolio tracker app is just fine.

Following is a list of more investing portfolio management tools:

YahooFinance Portfolio Tracker – This free investment portfolio tracker allows you to import from a spreadsheet or manually input your portfolio. The portfolio analyzer offers a list of investments with details including fundamentals, performance, news, and risk analysis.

Ticker app – Available for iOS and android devices, offers the opportunity to monitor multiple portfolio with colorful charts and graphs. The free stock tracking app shows positions, profits, losses, and news. Holdings must be manually input.

PortfolioVisualizer.com – Although, this free investment software is not a stock portfolio tracker but a sophsiticated investment analysis tool. We use it regularly to analyze our investment portfolios. The online portfolio analysis tools include; backtesting, Monte Carlo simulation, tactical asset allocation and optimization and more.

Sharesight.com – This free stock portfolio tracker is pervect for new investors with a few positions. Sharesight is a portfolio tracker with automatic holding updates, tax, and performance reporting. The first ten holdings are free. Sharesight, this investing portfolio management software also checks your dividends and stock splits, providing accurate performance data.

FAQ

What is investment management software?

Investment management software is a computer program or tracker that allows you to view details about your investments. Features include purchase, sale, dividends, capital gains, and price data. The software enables you to analyze your investments and find out which are preforming best and those that are lagging.

What is the best portfolio tracker app?

The best portfolio tracker app depends upon your own personal needs. In fact, many investment brokers offer their own tracker apps. Although to look at your investments that are owned in several accounts, we like the free portfolio tracker app from Personal Capital, due to the vast number of features.

What is the best investment tool?

The broad category of investment tools includes many money management apps that span the budgeting, saving, and investing software sphere. Mint is a great starter investment tool. For budgeting, YNAB is quite popular. To begin investing and learn, consider investigating the best robo advisors.

Which is better – Personal Capital or Mint?

They're both free investment management and tracking software, so why not try both? When it comes to sophisticated investment portfolio analysis tools – Personal Capital is best. For basic budgeting and money management, Mint is best.

The Best Portfolio Analysis Software Takeaway

Investment portfolio analysis software is useful to track returns, asset allocations and individual investment performance. From DIY spreadsheets to robo-advisors, there are many available options. Choosing an investment management system ultimately depends upon the features you're seeking. Regardless of which option you choose, the free Personal capital dashboard provides excellent investment insights and is quick to set up. It's worth signing up for Personal Capital, whether you choose another option or not, because of the detailed investment tracking and it's free.

In addition to these best investment portfolio management software, there are many additional low fee robo-advisors for your investment management needs. Check out our ever-growing Robo-Advisor Reviews section.

Disclosure: Please note that this article may contain affiliate links which means that – at zero cost to you – I might earn a commission if you sign up or buy through the affiliate link. That said, I never recommend anything I don't believe is valuable.

How To Calculate 401k Return When Constantly Adding Money

Source: https://www.roboadvisorpros.com/best-portfolio-management-software-for-investors/

Posted by: courtoisbittly.blogspot.com

0 Response to "How To Calculate 401k Return When Constantly Adding Money"

Post a Comment